Qpinch

Build your business case for using QHT technology

Defining the challenges for large scale processing industries

Energy Price Shift

Carbon Rates soaring

Net Zero Ambitions

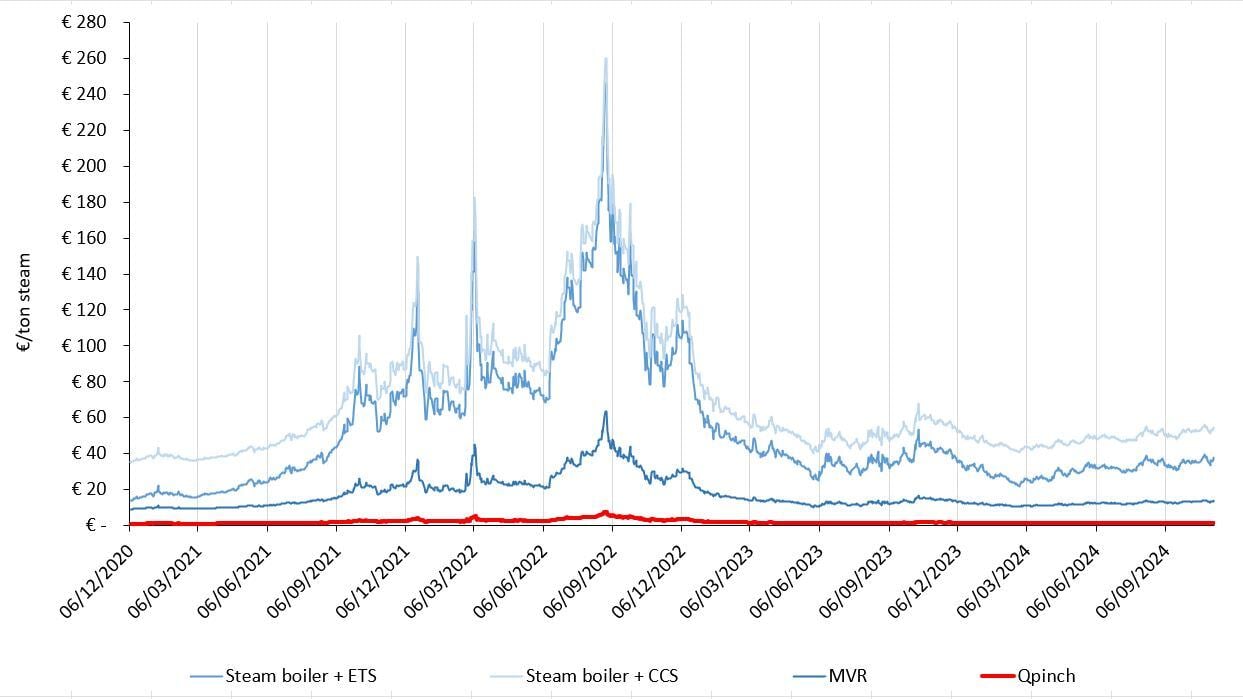

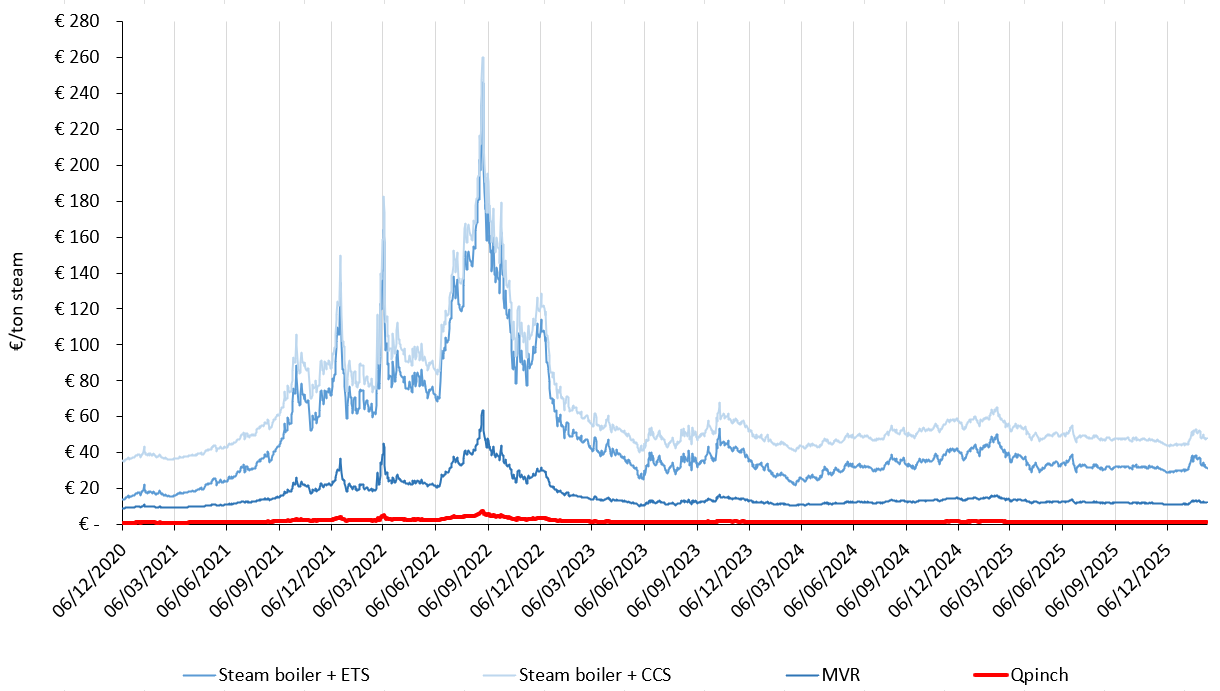

Volatile energy prices are here to stay

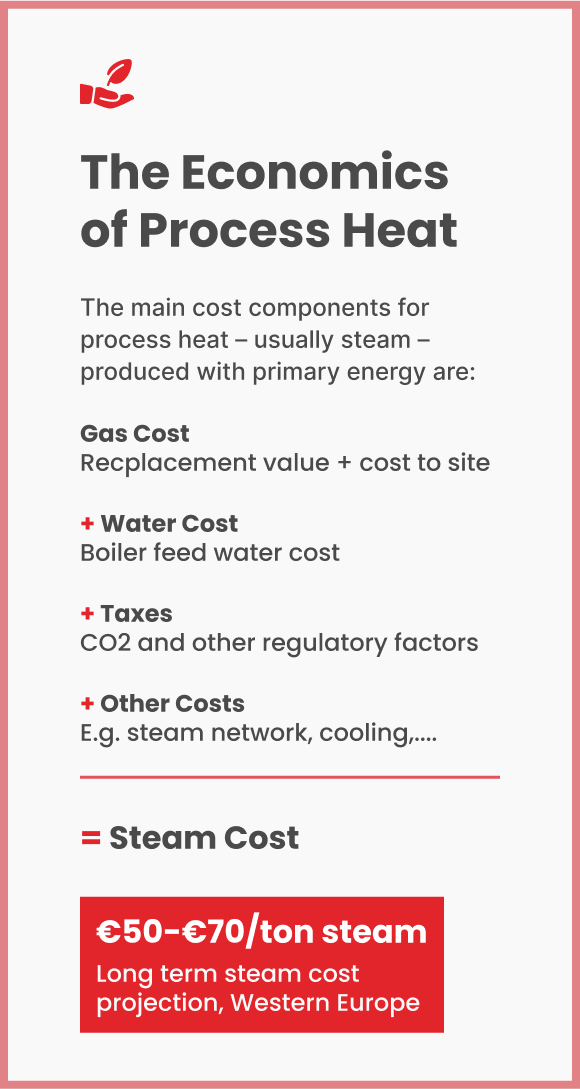

Commodity price

13/02/2026

Gas TTF per MWh: €32.5

EAU ETS CO2 per Ton: €69.31

Variable cost per ton of steam in Euro

13/02/2026

Gas boiler + ETS: €31.22

Gas boiler + CSS: €47.73

MVR: €12.16

Qpinch: €1,47

Qpinch is a hedge toward energy and CO2 prices

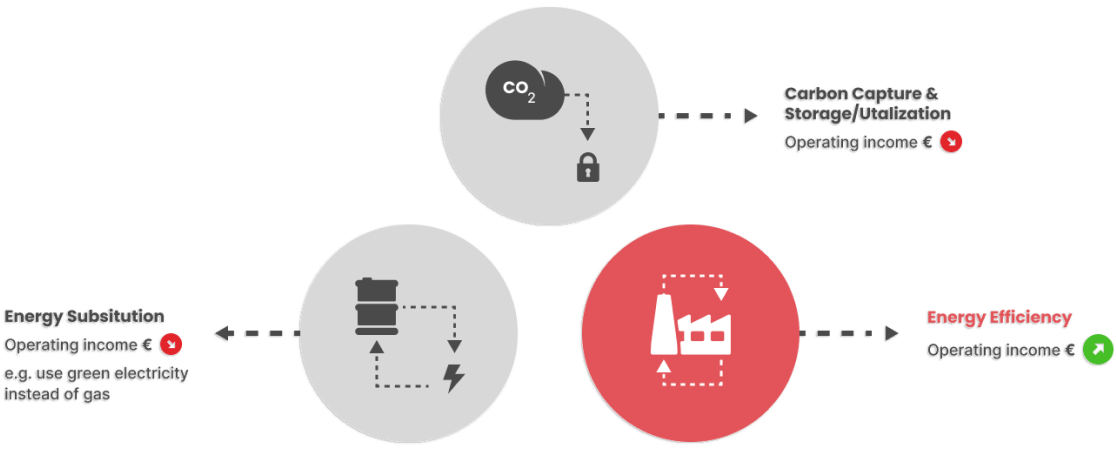

Solutions

Facing the challenges

There is no single overarching solution. We will need to combine them all. But more importantly, we need to act now. Implementing Energy Efficiency solutions as a first step will accelerate your progress and slingshot your budget.

Energy efficiency

Using less energy to perform the same task or produce the same result is the quickest way forward. QHT technology pursues this goal by recovering and reusing otherwise expelled waste heat.

Energy substitution

Finding commercially viable and durable alternative feedstock is at the heart of the energy transition. Together, we have agreed to phase out all grey energy consumption in the future.

Carbon Capture

Carbon Capturing and Sequestration, along with its reapplication (Utilisation) are necessary intermediate steps that will be relevant far beyond the 2050 milestone.

Carbon offsetting

A carbon offset is a reduction or removal of emissions of carbon dioxide or other greenhouse gases made in order to compensate for emissions made elsewhere. Offsets are measured in tonnes of carbon dioxide-equivalent.

Strategic options for Net Zero in industry by 2050

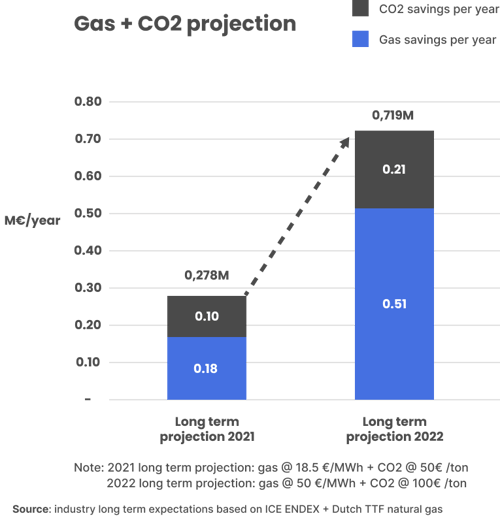

Long term expectations

Annual energy cost per MW steam

Low net OpEx

10x less electricity consumption compared to conventional heat pump technologies

Requires only a fraction of Scope 2 energy and technology sourcing

Requires only a fraction of the maintenance for it has no rotating components

The cheapest and most sustainable way to produce industrial stream

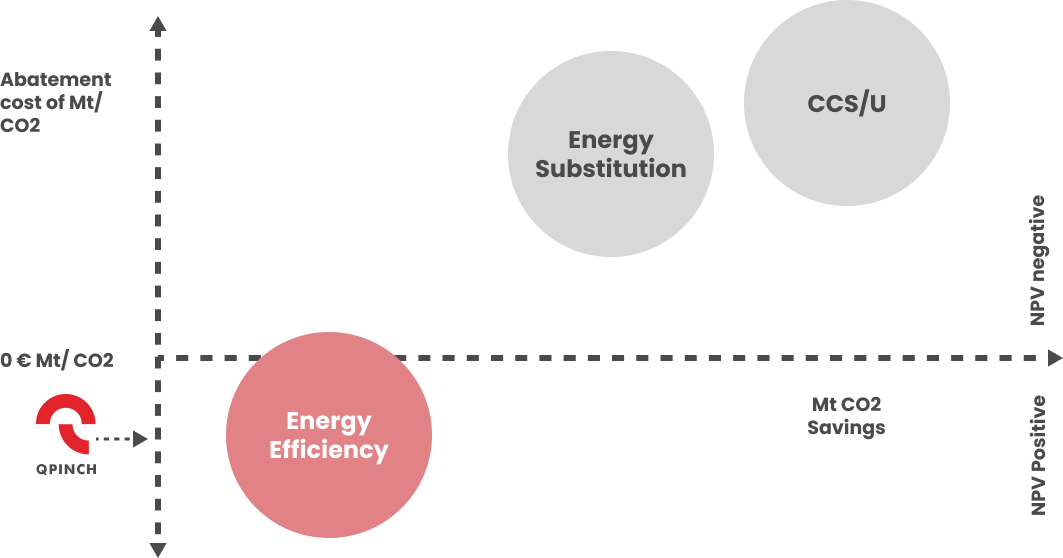

Strategic options for Net Zero in industry by 2050

The abatement cost curve in relation to QHT technology

The abatement cost curve identifies the different technologies to fully decarbonize a industrial site and at which cost, expressed in € per tonne CO2 abated per technology. Technologies with the lowest cost per tonne of CO2 are positioned on the far left side of the curve; the most expensive technologies are positioned on the right side of the curve.

The ideal placement on the matrix is on the far left and as close to the x-axis as possible, or even below it, if feasible. This specific position represents the CO2 emissions reduction in combination with the lowest investment cost. Technology that dips below the x-axis typically, or below current CO2 price (ETS or tax), results in cash generation and fast ROI.

Industry consumes a quarter of all energy

Contrary to public belief, the bulk of our energy is consumed while generating heat, not electricity.

This is particularly true for process industries, where heat is pervasive in the processes that produce the feedstock for the industrial sector as well as finished products for the consumer market. Surprisingly, when we introduced Qpinch at McKinsey’s 2017 SRP Summit in Stockholm, some of the attendees were equally astonished to learn that the industrial energy mix is very much biased towards natural gas and other fuels – not electricity.

International Energy Agency Governing Board Chairman Noé van Hulst pointed out in his commentary to the release of the agency’s Energy Efficiency Market Report 2016 that “energy efficiency is [the] energy resource that all countries have in abundance.”